Credit scores in America: What they are, why they matter, and how to build credit

Topics covered:

What makes up a credit score

How to start building credit

The habits that help or hurt your credit score

Good vs Excellent credit: At what number does credit score make a difference?

The credit system in the US was implemented in the 1950s as a way to standardize the representation of how creditworthy one is. It’s a numerical indicator that generally ranges from 300 to 850, which then guides a lender into making a decision about whether or not to lend, and at what terms.

A credit score is relevant anytime you try to get a loan (auto loan, residential loan), apply for a credit card, or even rent an apartment.

1. What makes up a credit score

Your credit score is a number between 300 and 850 that shows how good you are at managing your money. The higher the score, the more “trustworthy” one is when it comes to borrowing money and paying it back.

Lenders report your financial habits to one of three credit bureaus, which tabulate scores:

These agencies then use scoring models - FICO® or VantageScore - to come up with your credit score.

A credit report, which is akin to a financial report card, is created using that information. Each bureau offers free copies at AnnualCreditReport.com. If you have never seen one before, this Experian guide explains exactly what to look for.

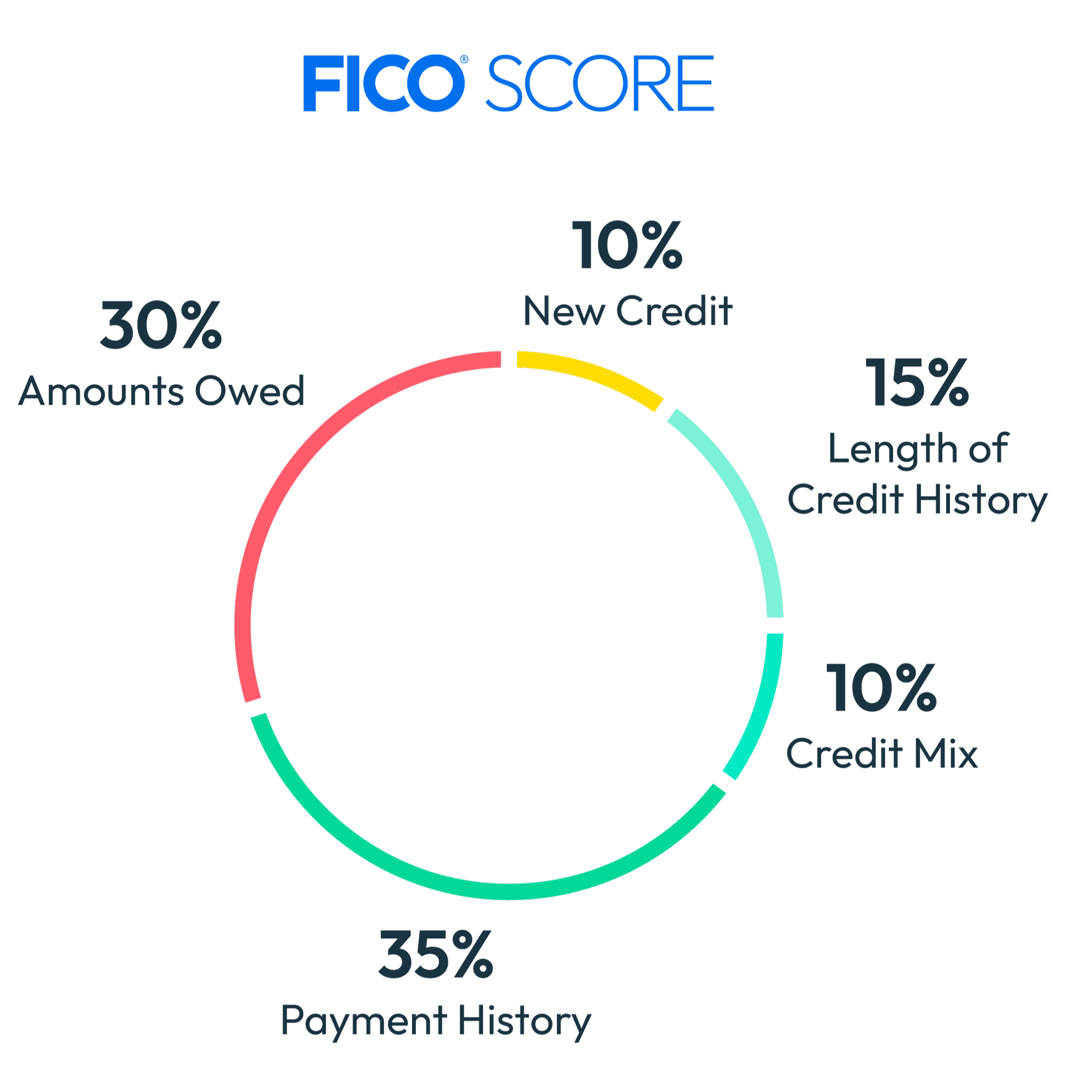

Financial habits that make up a credit score

Payment history (35%) - Do you pay your bills on time?

Amounts owed (30%) - How much of your available credit are you using?

Length of credit history (15%) - How long have you had credit?

New credit (10%) - Are you applying for a number of credit lines at once?

Credit mix (10%) - Do you have a mix of revolving (eg, credit cards) and fixed credit (eg, auto, mortgage)?

2. How to start building credit

If you've never been issued a loan or credit card in the US, you don't have credit. Newcomers to the US, you don't.

The classic route is to get your first credit card through a bank- read this article on How to get your first credit card in Boston. It wouldn’t matter if you’re making $300,000 a year; this first card will have a miserable $1,000 limit that will only be revised after you’ve proven yourself creditworthy.

You’ll be issued a score typically after 6 months of usage. Should you have used this first card with the credit behaviors that the bureaus like to see, your score at the end of this period will likely be between 600 to 650.

Two ways to expedite your score:

Get a credit-builder loan. Credit unions are a great avenue for these loans. You’d essentially open an account, deposit a sum of money into it, then "borrow" that money. It’s not free- you’d pay interest along the way.

Be an authorized user. Have a family member add you as an authorized user of their credit card. You’ll essentially inherit the payment history associated with that specific card account.

📣 PSA: Credit fraud might not be top of your mind when you’re busy opening new lines of credit and building your credit score, but they are absolutely a thing here in the US. You should take precaution by locking your credit.

3. Credit habits: The good, the bad, and the point losses that can happen quickly

Your credit score responds to your actions, sometimes more quickly than you might anticipate.

Habits that help a credit score:

Pay on time - Every bill, every month. Late payments can tank your score fast.

Keep your balances low - Do not use more than 30% of your overall limit. Best keep it under 10%, i.e. $500 on a $5,000 limit.

Hold onto old accounts - The longer your credit history, the better. Even if you’re no longer using that starter credit card, keep it until your score is relatively stable.

Habits that hurt a credit score:

Late payments - Just one can drop your score by 60 to 100+ points.

Maxing out your cards - Even if you pay on time, high balances hurt.

Too many new applications - Every time you apply for credit, it’s a “hard inquiry.” A few are fine, a bunch in a row are not.

Debt collections and defaults - These stick to your credit report for SEVEN years.

4. Good vs Excellent credit: At what number does credit score make a difference?

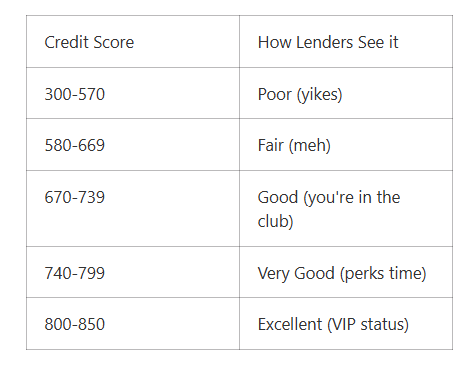

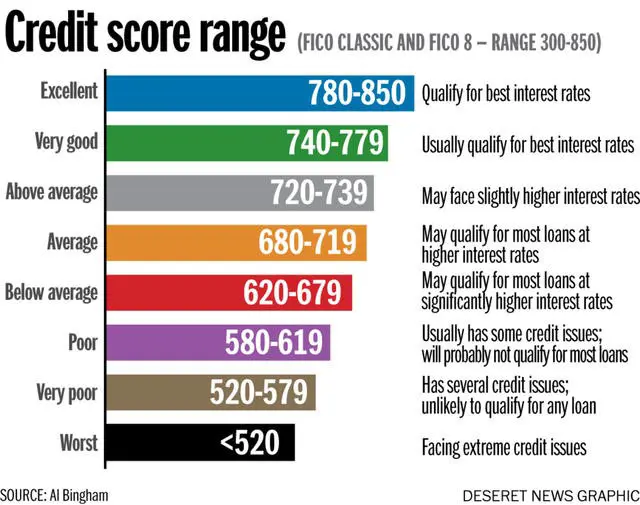

A 740 credit score is where a significant shift happens.

Here's the range of scores and how they read to lenders:

The models may vary slightly, but the logic stays the same: the closer you are to 850, the easier your financial access.

In real estate especially, 740 is the score where you’ll start to get serious perks: lower interest rates, better loan terms, and faster approvals. On a $1M loan over 30 years, a 6% interest rate as compared to a 6.5% interest rate translates to a difference of $118,385!

But it's not just residential home loans. A higher score can upgrade almost every part of your financial life: