Prevent credit fraud: Do this to lock your credit report

Credit fraud remains one of the fastest-growing financial crimes across the US, with millions of Americans falling victim each year to schemes like identity theft, account takeovers, and unauthorized credit applications. One of the most effective ways to safeguard your financial identity and prevent unauthorized usage is by freezing access to your credit reports with the three major credit bureaus: Experian, Equifax, and TransUnion.

1. What is credit fraud?

Credit fraud is a type of identity theft where financial information of a person is used without permission. It could happen in a number of scenarios, like using someone’s Social Security Number (SSN) to open new lines of credit, or stealing a credit card to make purchases. Credit fraud can happen through physical theft, online scams such as phishing and data breaches.

The unfortunate part is that many people don't realize they've been targeted until the fraud has already affected their credit scores. This fallout can be extensive: damaged credit, denied loan applications, and hours spent disputing fraudulent charges.

For a deeper understanding of how your credit works and why protecting it matters, read this article on Credit scores in America: What they are, why they matter, and how to build credit.

2. Freeze Credit vs Freezing SSN: What's the difference?

A credit freeze restricts access to one’s credit report, without which new financial accounts (credit cards, loans, etc.) cannot be opened. Note that a frozen access does not equate to a frozen score itself.

A Social Security Number (SSN) freeze (more of a lock, actually) helps protect against identity fraud by blocking electronic access to one’s SSN. It prevents situations like employment-related identity fraud where someone else works under your identity/SSN and reports wages in your name to the Internal Revenue Service (IRS), the Social Security Administration (SSA), and other authorities. Here’s how to lock your SSN for free.

3. Pros and cons of a credit freeze

Pros:

A credit freeze prevents hard inquiries, without which a new line of credit cannot be opened.

Signing up for an account with all three major credit bureaus is FREE (ignore ads seen on websites asking to pay for an account).

Initiating a credit freeze can be done online - takes a couple of minutes and super easy.

A freeze has no impact on credit score. Your score will still reflect your financial habits, i.e. it could still increase with a freeze in place.

Cons:

You must remember to temporarily unfreeze your credit before applying for things like a new credit card, a loan, or even a car lease.

To be fully protected, you must contact and manage the freeze with ALL three major credit bureaus (Equifax, Experian, and TransUnion).

4. How to freeze your credit score with Experian

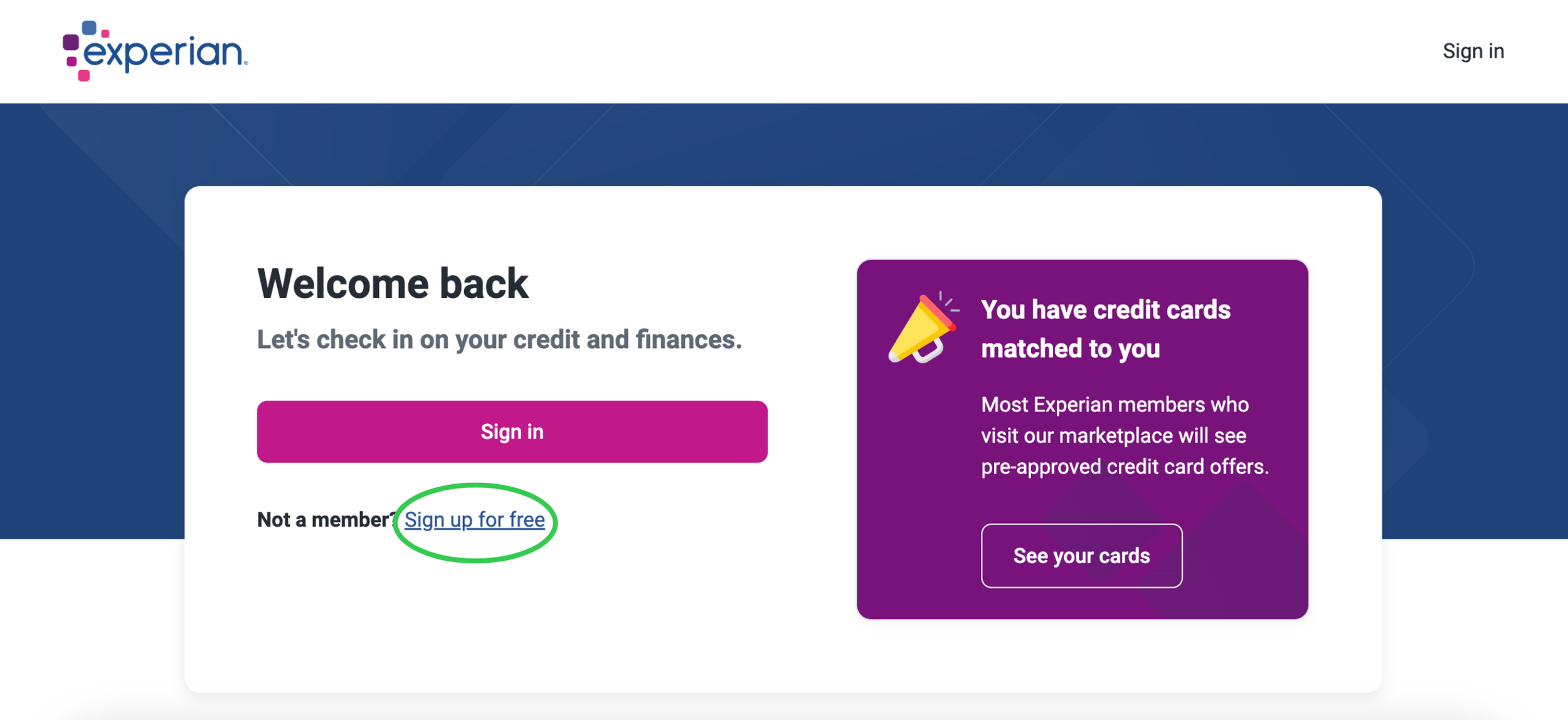

Sign up for a free account with Experian.

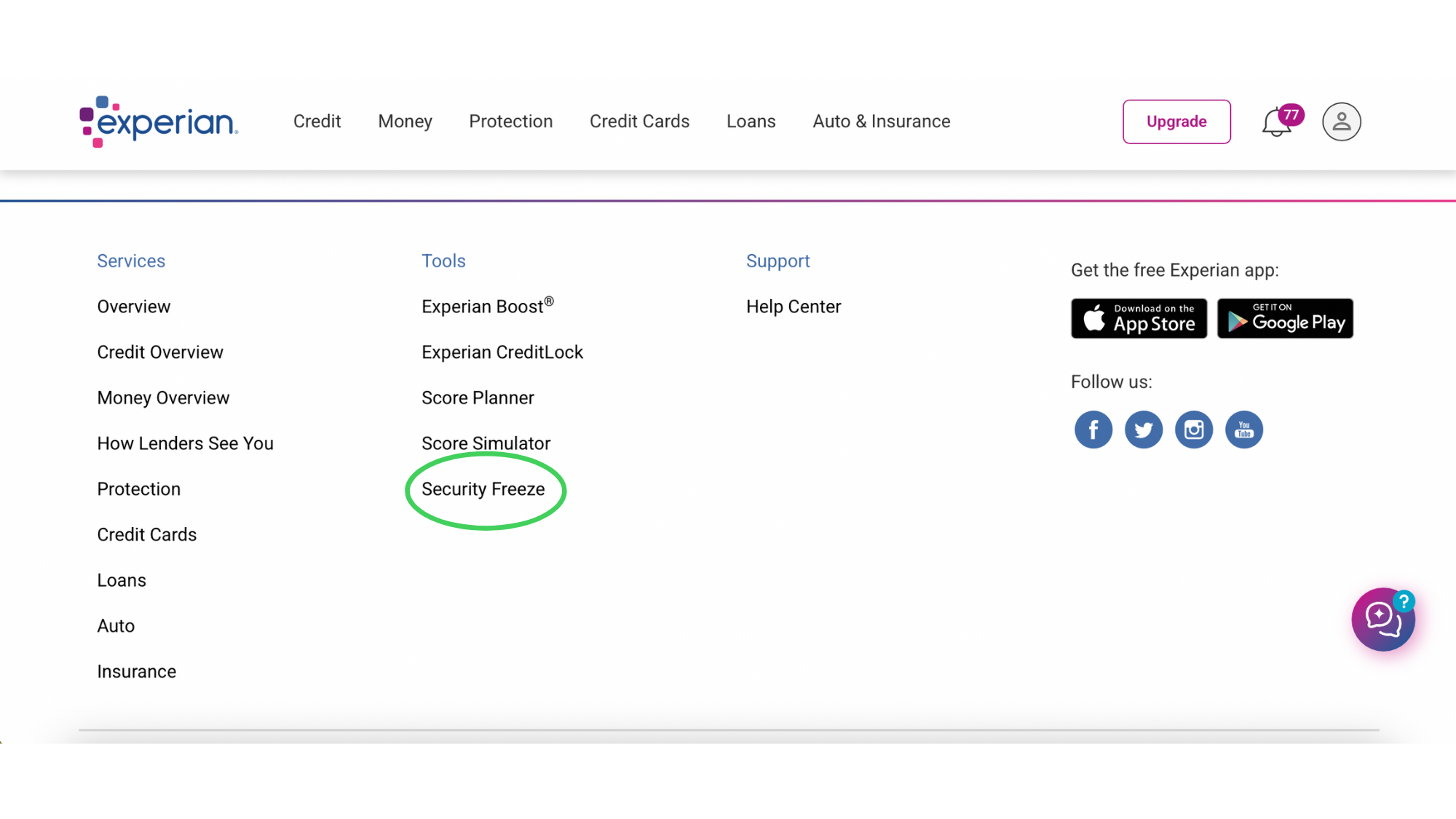

2. After logging in, ignore all the products Experian tries to sell on their homepage and simply scroll to the footer at the bottom. Click on “Security Freeze”.

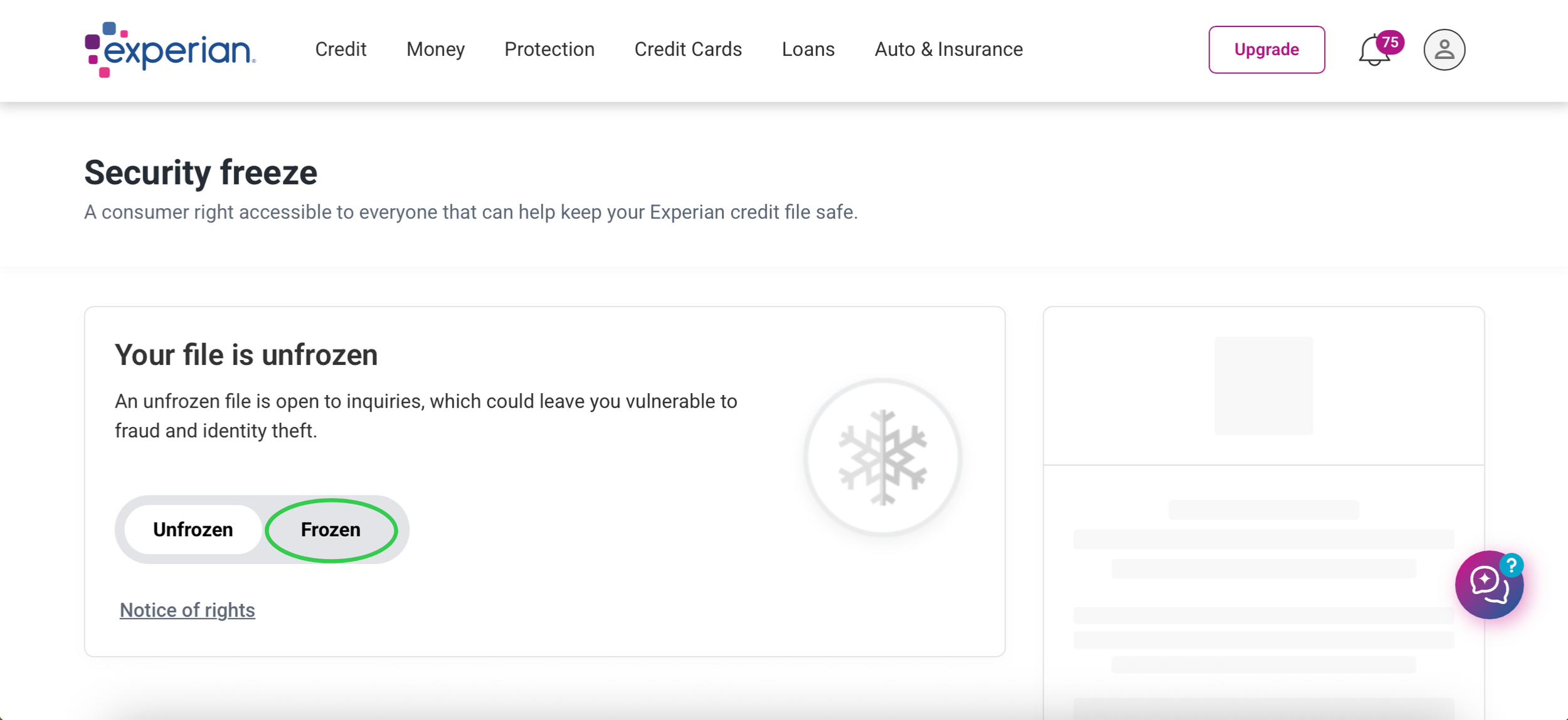

3. Click on “Frozen” to initiate a freeze.

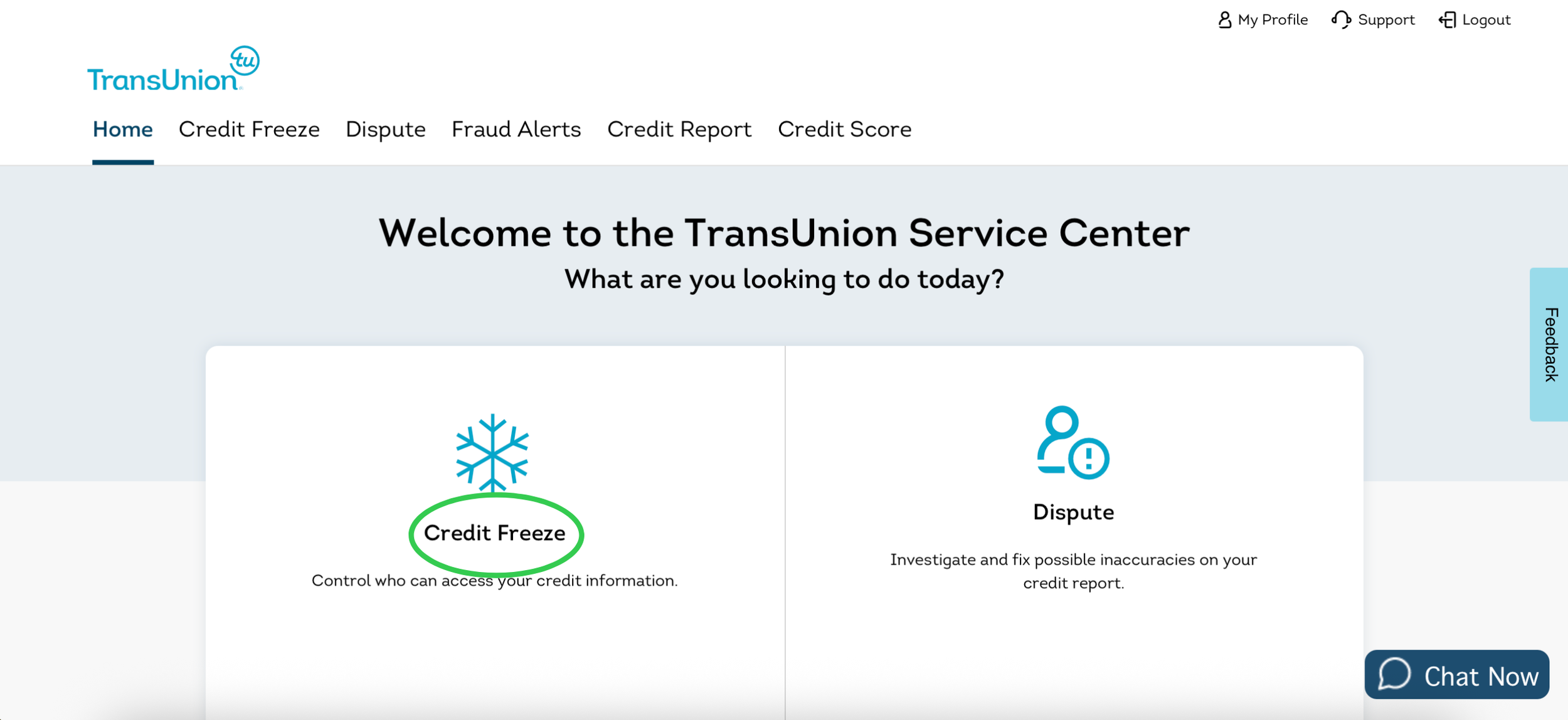

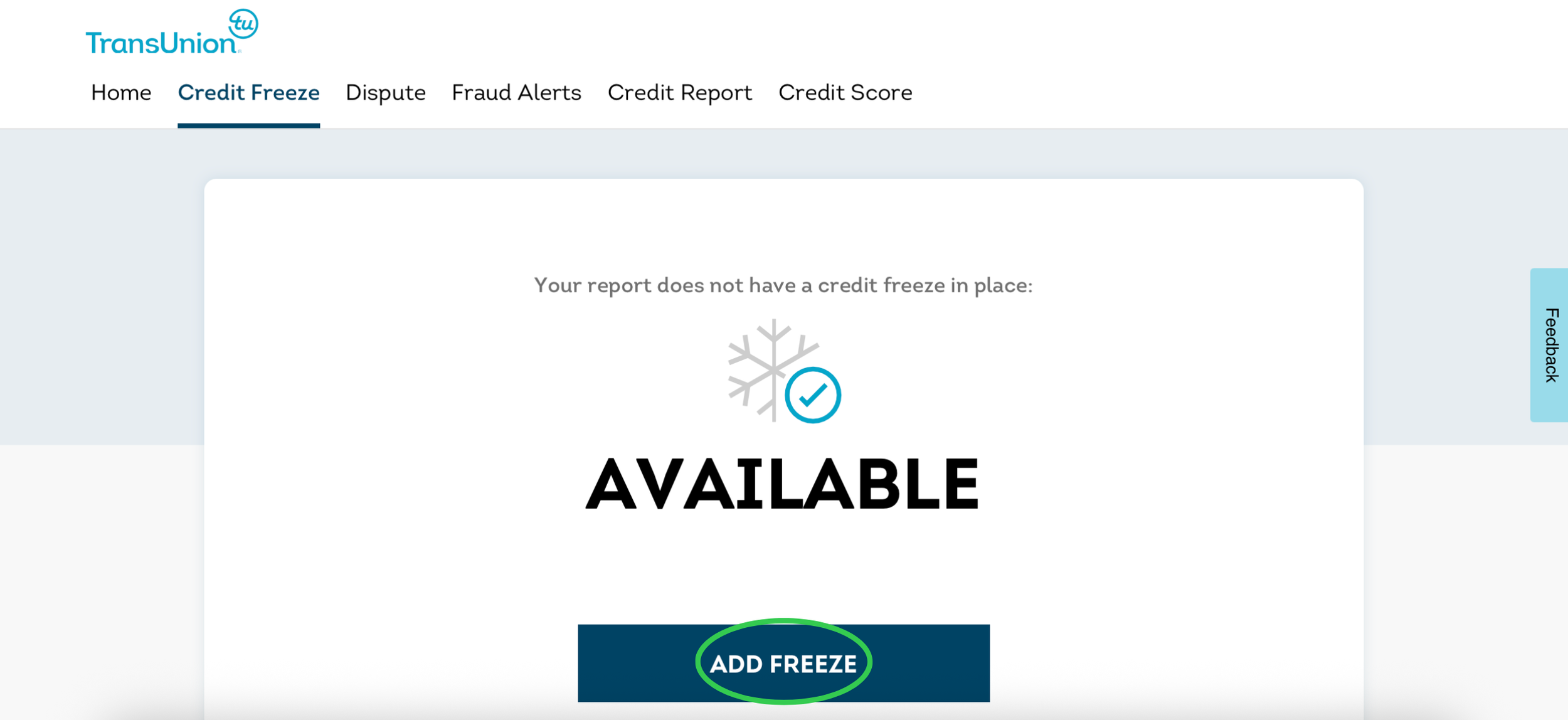

5. How to freeze your credit score with TransUnion

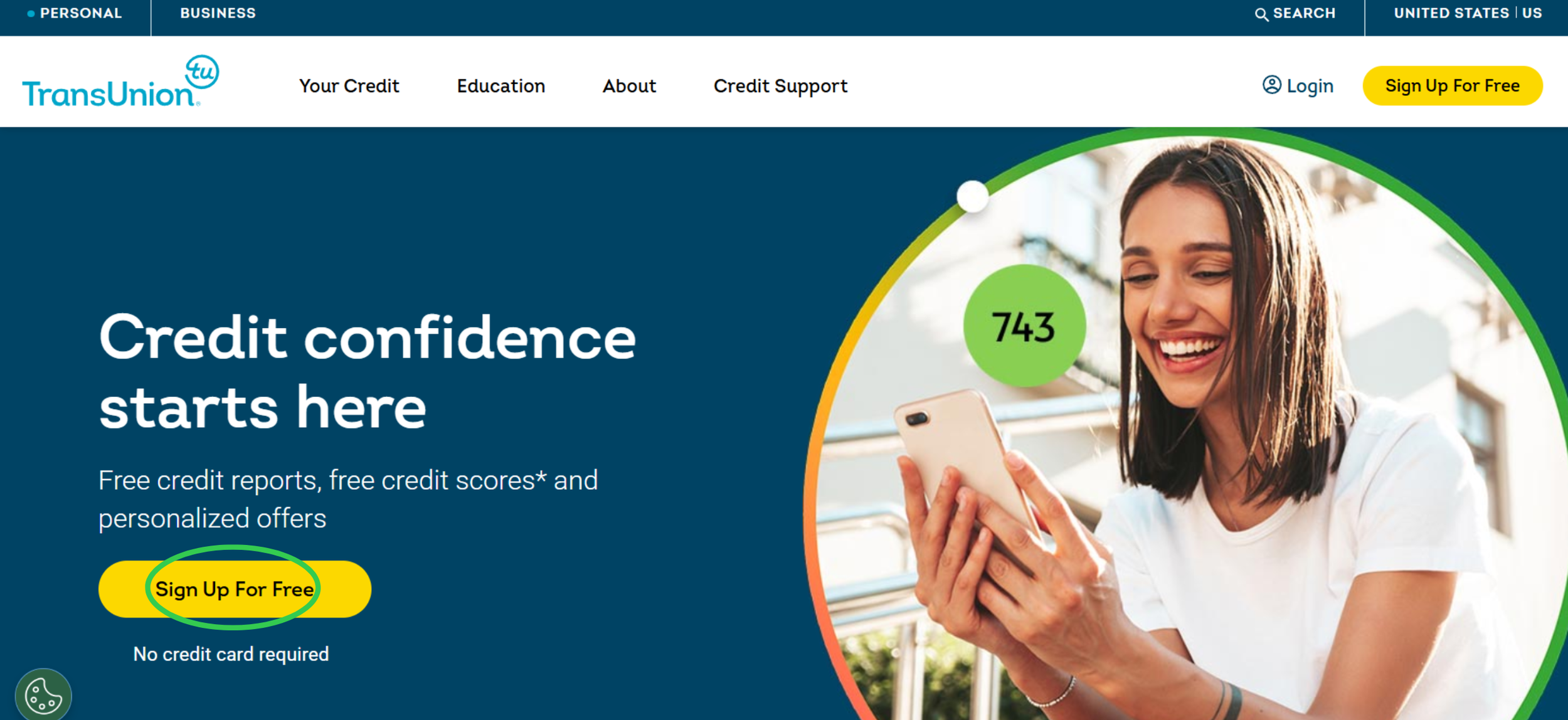

Sign up for a free account with TransUnion.

2. Click “Credit Freeze”.

3. Click “Add Freeze” to complete the process.

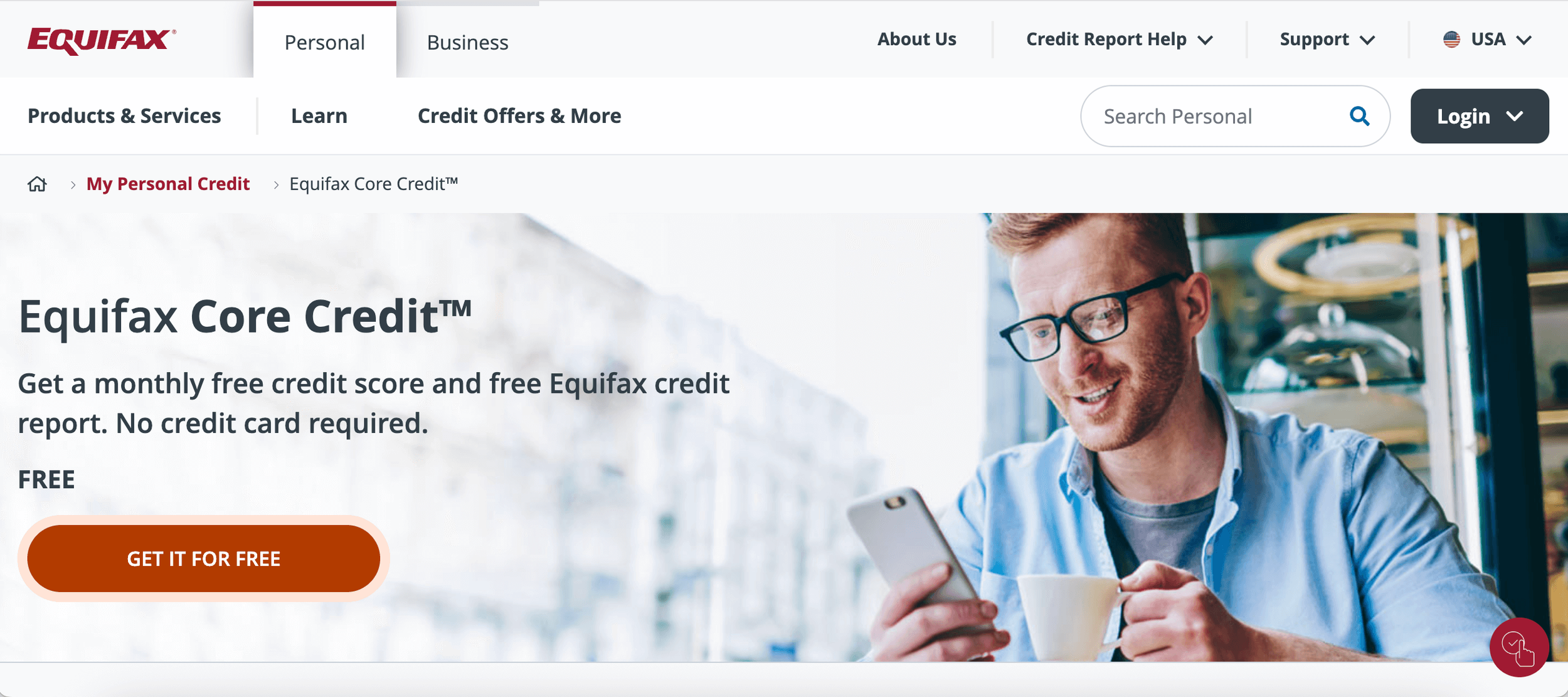

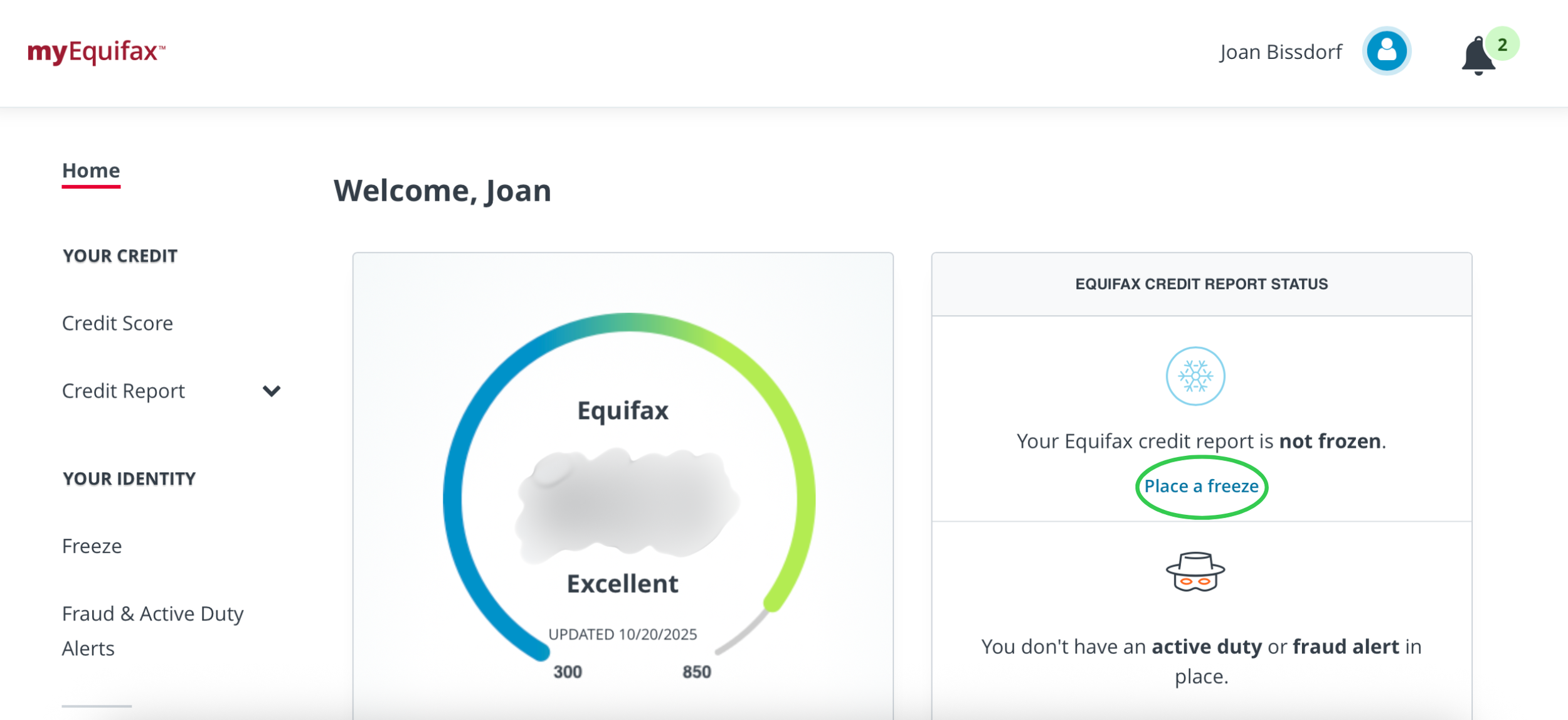

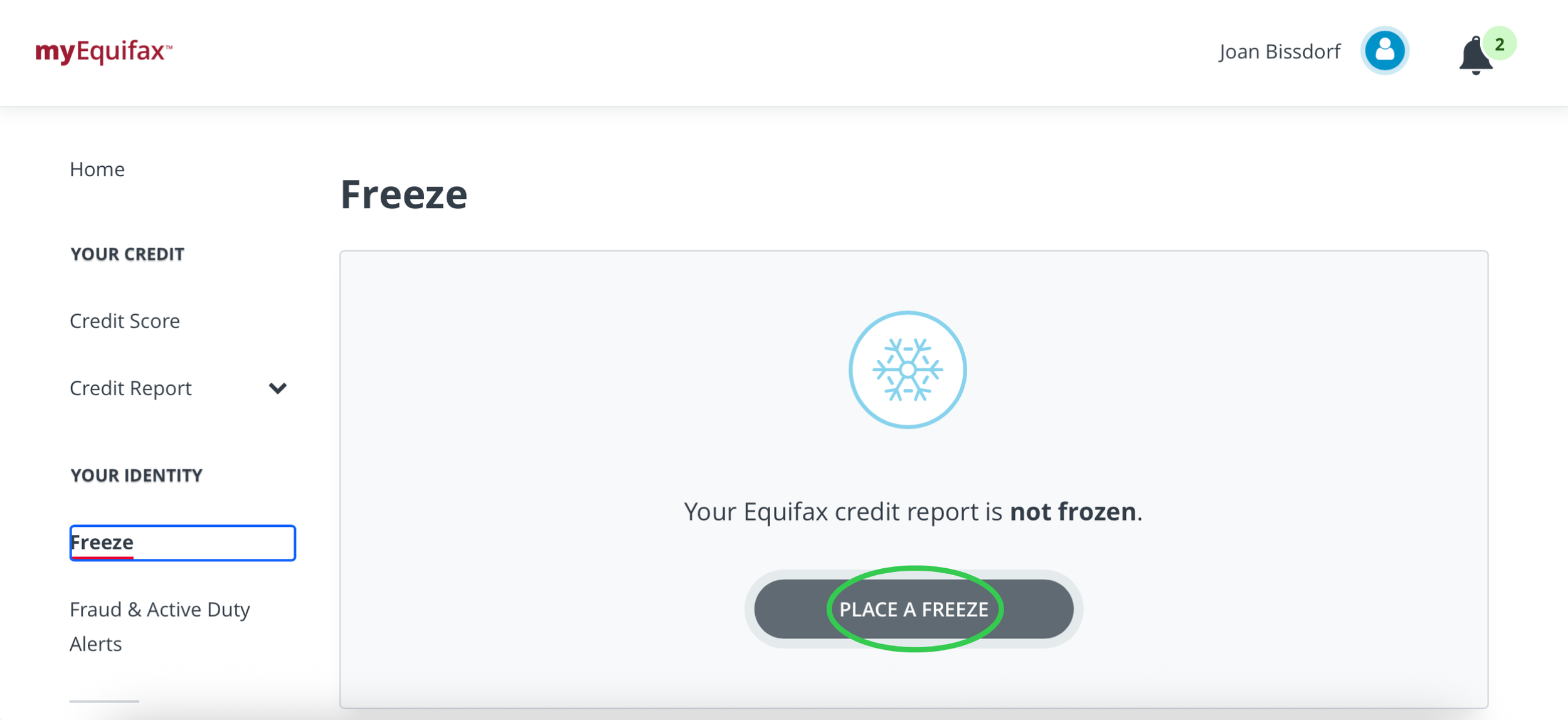

6. How to freeze your credit score with Equifax

Equifax’s user interface isn’t as straightforward as Experian’s or TransUnion’s - it’s filled with ads that sell protection plans. Here’s condensing the path to get to the free account.

Sign up for the free Equifax Core Credit™ account.

2. Click on “Place a freeze” on the right of the homepage.

3. Click “Place a freeze” to complete the process.